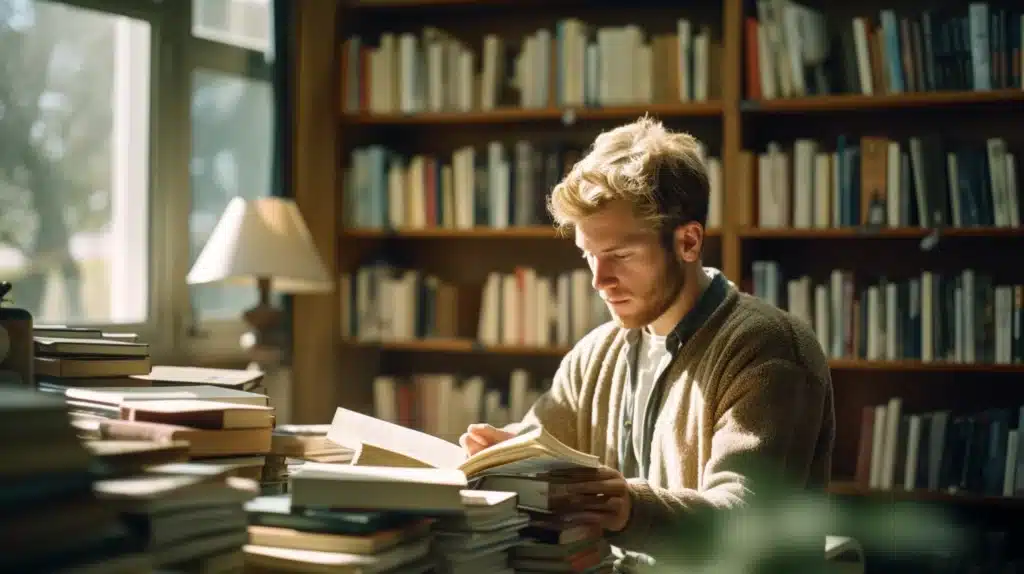

The 40 Best Self-Help & Personal Growth Books to Read in 2024

Reading good self-help books is the most reliable way to change your life for the better. While the self-improvement and personal growth industry has a mixed reputation, it’s undeniable that if you build the habit of reading self-help books, taking notes, and actioning valuable lessons, you can transform your life in profound ways.

As someone who has read 200+ books in the last five years, including dozens of self-improvement books and personal development books, I’m a firm believer that you can use books to improve almost any area of your life, including finding a fulfilling career, becoming more productive, learning how to navigate difficult times, developing new skills, and learning how to manage your money.

Given the volume of great works available from the world’s leading thinkers across disciplines, it’s clear that books can help you solve almost any problem in your life. But when it comes to self-help books, the most important thing you can do is choose the best books to read. With millions of personal development books available on the market, that task is easier said than done.

This article exists to help make the task of selecting the right self-help books easier. Below, you will find 40 of the best self-improvement books of all time, broken down by categories so that you can find the book that fits your life and current needs. If you get started with these books and put the lessons into practice, you will move closer to where you want to go.

The Best Self-Help Books To Make Your Life Better

- Best Self-Help Books for Everyone

- Best Self-Help Books for Difficult Times

- Best Self-Help Books for Productivity

- Best Self-Help Books for Women

- Best Self-Help Books for Men

- Best Self-Help Books for Your 20s

- Best Self-Help Books for Your Career

- Best Self-Help Books for Relationships & Romance

- Best Self-Help Books for Your Mind

- Best Self-Help Books for Your Finances

- Best Self-Help Books for Creativity

- How to Get More From Self-Help Books

- Additional Book Lists

Best Self-Help Books for Everyone

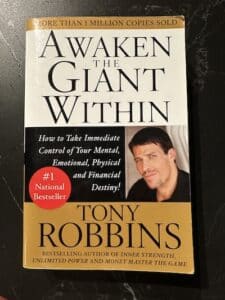

1. Awaken the Giant Within by Tony Robbins

“Achievers rarely, if ever, see a problem as permanent, while those who fail see even the smallest problems as permanent.”

Rating: 9/10

Why it’s Great: A classic self-improvement book for people who want to embark on a deep psychological investigation of their mind, body, emotions, and finances. You’ll learn about the motivating forces of pain and pleasure, the importance of the questions you ask, and how to clarify and live by your values. Read it slowly and do the exercises.

2. The Subtle Art Of Not Giving A F*Ck By Mark Manson

“The rare people who do become truly exceptional at something do so not because they believe they’re exceptional. On the contrary, they become amazing because they’re obsessed with improvement. And that obsession with improvement stems from an unerring belief that they are, in fact, not that great at all.”

Rating: 9.5/10

Why it’s Great: Mark Manson provides philosophical and candid thoughts on how we can live a better life, starting with rejecting the fluffy, positive psychology obsessed self-improvement culture of the modern era. He explores what it means to embrace the negative aspects of life, take responsibility for everything that happens to us, prioritize good values, and choose the problems that we solve.

3. How to Stop Worrying and Start Living by Dale Carnegie

“The greatest mistake physicians make is that they attempt to cure the body without attempting to cure the mind; yet the mind and body are one and should not be treated separately.” – Plato

Rating: 9/10

Why it’s Great: In this time-tested book, Dale Carnegie shows us how to conquer worry and anxiety. Via engaging stories that reveal helpful lessons and practical frameworks, Carnegie arms you with an array of tools that will help you start living more fully and without the harmful effects of worry. Even though this book was written in 1936, the deceptively simple lessons from this book will help you better navigate the noise of the modern era.

4. The Alchemist by Paulo Coelho

“It’s the possibility of having a dream come true that makes life interesting.”

Rating: 9/10

Why it’s Great: Through an elegant narrative about an Andalusian shepherd boy, Coelho communicates essential life lessons, including the importance of pursuing your passions, living in the present moment, and doing things with love and enthusiasm.

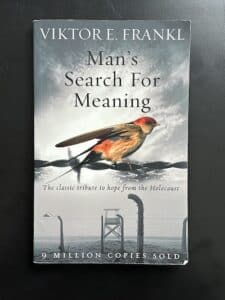

5. Man’s Search for Meaning by Viktor Frankl

“When we are no longer able to change a situation, we are challenged to change ourselves.”

Rating: 10/10

Why it’s Great: In this heart-wrenching story, Holocaust survivor and psychiatrist Viktor Frankl leverages his personal experiences in Nazi concentration camps and the philosophy of logotherapy to show you that you can overcome and find meaning in the face of unimaginable tragedy. His core idea is that while we cannot control what happens to us, we can control how we respond to everything we encounter in life.

Best Self-Help Books for Difficult Times

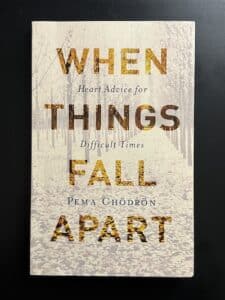

6. When Things Fall Apart by Pema Chodron

“To be fully alive, fully human, and completely awake is to be continually thrown out of the nest. To live fully is to be always in no-man’s land, to experience each moment as completely new and fresh. To live is to be willing to die over and over again.”

Rating: 9/10

Why it’s Great: This book will help you navigate the peaks and valleys of life. Buddhist Pema Chodron shares a compelling philosophy of how to live in a fundamentally shifting world and introduces many concepts from Buddhism that you can incorporate into your life.

7. The Obstacle Is The Way By Ryan Holiday

“We blame our bosses, the economy, our politicians, other people, or we write ourselves off as failures or our goals as impossible. When really only one thing is at fault: our attitude and approach.”

Rating: 8.5/10

Why it’s Great: A practical and actionable philosophy on how to perceive, act, and thrive in an uncertain and changing world. Leveraging the wisdom of the Stoics, Holiday explains how we can deliberately improve the way we perceive the world and find opportunities in the obstacles we face.

8. Meditations By Marcus Aurelius

“Nowhere you can go is more peaceful—more free of interruptions—than your own soul. Especially if you have other things to rely on. An instant’s recollection and there it is: complete tranquillity. And by tranquillity I mean a kind of harmony.”

Rating: 9/10

Why it’s Great: This is a life-changing collection of philosophical and spiritual thoughts from the former Roman emperor Marcus Aurelius. The work is grounded in Stoicism, a practical philosophy that encourages us to keep our mortality in mind at all times, view things as they are, reflect thoughtfully, focus on what’s within our control, and practice virtues like generosity, honesty, and self-control.

Best Self-Help Books for Productivity

9. Essentialism: The Disciplined Pursuit Of Less By Greg McKeown

“Essentialists spend as much time as possible exploring, listening, debating, questioning, and thinking. But their exploration is not an end in itself. The purpose of the exploration is to discern the vital few from the trivial many.”

Rating: 9/10

Why it’s Great: A compelling philosophy about living consciously, focusing on the essential few things that fulfill you, and designing your life to achieve your highest point of contribution. McKeown highlights the danger of failing to recognize tradeoffs, the necessity of learning to say no, the value of deep work, and the importance of play and sleep.

10. The Power of Habit by Charles Duhigg

“And once you understand that habits can change, you have the freedom—and the responsibility—to remake them. Once you understand that habits can be rebuilt, the power of habit becomes easier to grasp, and the only option left is to get to work.”

Rating: 8/10

Why it’s Great: Good habits are the foundation of all personal success. The Power of Habit is a digestible and informed examination of why habits exist, how they work, and how you can change them. This book will give you the foundational understanding required to make new habits stick and break old habits that are limiting your daily life. Pair this book with Atomic Habits by James Clear to develop more self-mastery, live a happy life, and achieve success.

11. The Goal: A Process of Ongoing Improvement by Eliyahu Goldratt

“Since the strength of the chain is determined by the weakest link, then the first step to improve an organization must be to identify the weakest link.”

Rating: 8/10

Why it’s Great: The Goal does not make most personal development book lists, and that’s a shame. Through an engaging fictional story about a manager who has 90 days to turn around his plant, author Eliyahu Goldratt teaches you the first principles of operating and improving any system. Reading this book will show you how to implement an effective and efficient process of ongoing improvement. His approach provides you with a valuable skill that will allow you to better approach problems in life and business.

Best Self-Help Books for Women

12. Radical Acceptance by Tara Brach

“While desire naturally arises again, the wisdom of seeing that everything passes is liberating. Observing desire without acting on it enlarges our freedom to choose how we live.”

Rating: 8/10

Why it’s Great: If you have ever struggled with self-compassion, self-love, or low self-esteem, Radical Acceptance is the book for you. Clinical psychologist and meditation teacher, Tara Brach, introduces a fantastic approach that will help you live life with a better understanding of your experiences and emotions.

13. The 48 Laws of Power by Robert Greene

“When you show yourself to the world and display your talents, you naturally stir all kinds of resentment, envy, and other manifestations of insecurity… you cannot spend your life worrying about the petty feelings of others”

Rating: 8/10

Why it’s Great: The 48 Laws of Power is a timeless guide that offers a dense, candid, and frightening examination of power and its many dynamics. If you want to understand human nature, get better at identifying bad actors, and avoid the pitfalls of naive positive thinking, this is one of the best personal development books to get a new perspective.

14. The Power of Now: A Guide to Spiritual Enlightenment by Eckhart Tolle

“To complain is always non-acceptance of what is.”

Rating: 9/10

Why it’s Great: Eckhart Tolle explores presence, thinking, and spirituality to help you understand what presence means, how thinking and non-acceptance drive a lot of human pain, and how to live a life that reduces suffering.

Best Self-Help Books for Men

15. Own the Day, Own Your Life by Aubrey Marcus

“To live one day well is the same as to live ten thousand days well. To master twenty-four hours is to master your life.”

Rating: 8/10

Why it’s Great: A no-nonsense book with tactical, science-backed insights on how to live a healthier, energy-filled, and fulfilling life. Many practices in this book have helped me boost my daily energy and productivity.

16. The Lessons of History by Will and Ariel Durant

“So the first biological lesson of history is that life is competition. Competition is not only the life of trade, it is the trade of life—peaceful when food abounds, violent when the mouths outrun the food.”

Rating: 9/10

Why it’s Great: A concise, thematic account of history that covers the core biological, social, economic, and philosophical lessons of history. The Durants introduce you to everything from the 3 fundamental biological lessons of life to the origins of racial antipathies.

17. Zen And The Art Of Motorcycle Maintenance By Robert Pirsig

“You are never dedicated to something you have complete confidence in. No one is fanatically shouting that the sun is going to rise tomorrow. They know it’s going to rise tomorrow. When people are fanatically dedicated to political or religious faiths or any other kinds of dogmas or goals, it’s always because these dogmas or goals are in doubt.”

Rating: 9/10

Why it’s Great: Pirsig takes us on a philosophical journey through the engaging narrative of a middle-aged man who takes his son on a motorcycle trip across America. You’ll walk away with a newfound appreciation for philosophy and the great interconnectedness of the world.

Best Self-Help Books for Your 20s

18. Designing Your Life by Bill Burnett and Dave Evans

“Life is all about growth and change. It’s not static. It’s not about some destination. It’s not about answering the question once and for all and then it’s all done. Nobody really knows what he or she wants to be.”

Rating: 8/10

Why it’s Great: In this book, Stanford professors Bill Burnett and Dave Evans show you how to use design thinking to create a meaningful, joyful, and fulfilling life. If you fully engage with the frameworks and self-reflection exercises, you will have a clearer path to creating a life worth living.

19. The Defining Decade by Meg Jay

“Goals direct us from the inside, but shoulds are paralyzing judgments from the outside. Goals feel like authentic dreams while shoulds feel like oppressive obligations. Shoulds set up a false dichotomy between either meeting an ideal or being a failure, between perfection or settling. The tyranny of the should even pits us against our own best interests.”

Rating: 8/10

Why it’s Great: This book directly challenges the thirty-is-the-new-twenty culture. Through research and anecdotes from her time as a clinical psychologist, Meg Jay advocates for being intentional about how you spend your twenties.

20. Wanting: The Power of Mimetic Desire in Everyday Life by Luke Burgis

“We can never know what to want, because, living only one life, we can neither compare it with our previous lives nor perfect it in our lives to come.” – Milan Kundera

Rating: 8/10

Why it’s Great: Wanting is a transformational deep dive into the origins of desire. In it, Luke Burgis shows us how we come to want certain things in life and how we can transform our relationship with desire in ways that allow us to live a more aligned, fulfilling existence with other people. Burgis’s work builds off of the philosophy of René Girard, a French philosopher who spent his life understanding and writing about the human condition.

21. Mistakes Were Made (But Not by Me) by Caroll Tavris and Elliot Aronson

“Our convictions about who we are carry us through the day, and we are constantly interpreting the things that happen to us through the filter of those core beliefs.”

Rating: 8/10

Why it’s Great: An insightful examination of how and why we self-justify everything we do and the dangers of this human tendency to self-justify. You will walk away with a humbling skepticism about the reliability of your memory, the source of your beliefs, and the motivations behind your actions.

Best Self-Help Books for Your Career

22. Shoe Dog by Phil Knight

“Don’t tell people how to do things, tell them what to do and let them surprise you with their results.”

Rating: 9/10

Why it’s Great: Phil Knight recounts his struggles, victories, and lessons learned from building Nike from a small startup to a billion dollar shoe giant. He tells engaging and inspiring stories that highlight his personal philosophies on life. Knight encourages us all to seek and pursue a calling, even if we don’t yet know what that means.

23. Never Split the Difference by Chris Voss

“Persuasion is not about how bright or smooth or forceful you are. It’s about the other party convincing themselves that the solution you want is their own idea. So don’t beat them with logic or brute force. Ask them questions that open paths to your goals. It’s not about you.”

Rating: 9/10

Why it’s Great: International hostage negotiator Chris Voss provides a practical guide and set of principles to improve your effectiveness in getting what you want. You’ll learn that being a good negotiator is about being an effective communicator, understanding what drives people’s decisions, and using counterintuitive techniques, such as asking calibrated questions, beginning with “no”, and listening actively and empathetically.

24. Give And Take: Why Helping Others Drives Our Success By Adam Grant

“Highly successful people have three things in common: motivation, ability, and opportunity. If we want to succeed, we need a combination of hard work, talent, and luck.”

Rating: 9/10

Why it’s Great: This book reshaped my understanding of what drives success. With an engaging body of research, Wharton professor Adam Grant demonstrates how, combined with motivation, ability, and opportunity, being a giver in our attitudes and actions towards others can fuel our long-term personal and career success.

25. How To Lie With Statistics By Darrell Huff

“‘Does it make sense?’ will often cut a statistic down to size when the whole rigmarole is based on an unproved assumption.”

Rating: 8/10

Why it’s Great: We all learn statistics in school, but rarely do we apply the important and basic principles of statistics in adulthood. This book is a great primer on statistics that shows you all of the ways in which we are manipulated by data at work, in the news, and more.

Best Self-Help Books for Relationships & Romance

26. How to Win Friends and Influence People by Dale Carnegie

“You can make more friends in two months by becoming interested in other people than you can in two years by trying to get other people interested in you.”

Rating: 8/10

Why it’s great: How to Win Friends and Influence People is one of the best self-improvement books of all time. It is full of practical advice for anyone who wants to improve their relationships, influence people, and achieve success. Above all else, Carnegie teaches us that connecting with other people is a skill (not a natural talent) and that through being honest with our shortcomings and intentional in our efforts to overcome those challenges, we develop more self-confidence and rewarding relationships.

27. The Four Agreements by Don Miguel Ruiz

“Making assumptions in relationships leads to a lot of fights, a lot of difficulties, a lot of misunderstandings with people we supposedly love.”

Rating: 8/10

Why it’s great: Leveraging the teachings and wisdom of the ancient Toltecs, Don Miguel Ruiz takes you on a spiritual and philosophical path of understanding and changing the agreements you have with yourself. He first shows how you are indoctrinated with beliefs that harm your well-being and then teaches you how to reshape those beliefs. The result is that you leave the book with four new agreements that will help you create a life of connection, joy, and fulfillment.

28. Models: Attract Women Through Honesty by Mark Manson

“…vulnerability is not a technique or tactic. It is a way of being. It’s not something you learn, it’s a mindset you practice.”

Rating: 9/10

Why it’s Great: Personal development extends to all areas of life, including your romantic endeavors. If you’re struggling in your romantic life, Models is a wonderful book. Author Mark Manson will help you understand how to be less needy, express yourself in healthy ways, and get comfortable with dating in an attempt to make your dating life easier and more rewarding.

Best Self-Help Books for Your Mind

29. Awareness: Conversations with the Masters by Anthony de Mello

“When you renounce or fight something, you become tied to it. In fighting it, you give it power. So instead of fighting, give in. You might find that what you’ve been resisting no longer holds the same power over you.”

Rating: 9/10

Why it’s Great: Awareness is nourishment for the soul. In a humorous and digestible way, Anthony de Mello helps you understand yourself and the world in a way that will help you improve the quality of your life.

30. Wherever You Go, There You Are by Jon Kabat-Zinn

“Meditation is neither shutting things out nor off. It is seeing things clearly, and deliberately positioning yourself differently in relationship to them.”

Rating: 8/10

Why it’s Great: A clear and engaging introduction to practicing meditation and cultivating mindfulness in your life as a pathway to personal development. You will learn about what meditation and mindfulness are, why they matter, how to introduce them to your daily activities and way of operating. If you’re interested in living a life with more clarity, presence, awareness, and acceptance, this book will help you get there.

31. On the Shortness of Life by Seneca

“It is not that we have a short time to live, but that we waste a lot of it.”

Rating: 8/10

Why it’s Great: On the Shortness of Life is one of those self-improvement books that will make you think. Unlike books that rely on ever-changing scientific research, the Stoic philosopher Seneca uses his life experience to reveal time-tested insights about how to live a good life. Through stories, he reveals the wisdom in slowing down, the futility of worrying about the future, the importance of learning how to master your emotions, and how to act in the face of uncertainty.

32. When Breath Becomes Air by Paul Kalanithi

“I began to realize that coming in such close contact with my own mortality had changed both nothing and everything. Before my cancer was diagnosed, I knew that someday I would die, but I didn’t know when. After the diagnosis, I knew that someday I would die, but I didn’t know when. But now I knew it acutely. The problem wasn’t really a scientific one. The fact of death is unsettling. Yet there is no other way to live.”

Rating: 9/10

Why it’s Great: What a wonderfully heavy and moving read that offers a window into the human mind grappling with the precipice of life and death. In it, neurosurgeon Paul Kalanithi confronts the question of what makes life meaningful in the face of death. He wrote the book after being diagnosed with Stage IV lung cancer at the peak of his career.

Best Self-Help Books for Your Finances

33. The Psychology of Money by Morgan Housel

“Getting money requires taking risks, being optimistic, and putting yourself out there. But keeping money requires the opposite of taking risk. It requires humility, and fear that what you’ve made can be taken away from you just as fast. It requires frugality and an acceptance that at least some of what you’ve made is attributable to luck, so past success can’t be relied upon to repeat indefinitely.”

Rating: 9.5/10

Why it’s Great: In the Psychology of Money, Morgan Housel teaches you how to have a better relationship with money and to make smarter financial decisions. Instead of pretending that humans are ROI-optimizing machines, he shows you how your psychology can work for and against you.

34. A Random Walk Down Wall Street: Including A Life-Cycle Guide To Personal Investing By Burton Malkiel

“The core of every portfolio should consist of low-cost, tax-efficient, broad-based index funds.”

Rating: 9/10

Why it’s Great: A Random Walk Down Wall Street is a classic guide full of amazing research that blends history, economics, market theory, and behavioral finance to offer practical and actionable advice for investing and achieving financial freedom. Malkiel’s central message is abundantly clear – begin a consistent savings plan as early as possible and invest the core of your portfolio in low-cost, broad-based index funds.

35. The Simple Path to Wealth by JL Collins

“Since money is the single most powerful tool we have for navigating this complex world we’ve created, understanding it is critical. If you choose to master it, money becomes a wonderful servant. If you don’t, it will surely master you.”

Rating: 9/10

Read this book if you want to get your personal finances in order. In a simple, engaging way, Collins shares the basic wisdom you need to make your money work for you, not against you. You’ll walk away with a practical toolkit to achieving financial freedom with minimal effort.

36. Rich Dad Poor Dad By Robert Kiyosaki

“It’s fear that keeps most people working at a job: the fear of not paying the bills, the fear of being fired, the fear of not having enough money, and the fear of starting over. That’s the price of studying to learn a profession or trade, and then working for money. Most people become a slave to money – and then get angry with their boss.”

Rating: 7.5/10

Why it’s Great: In Rich Dad Poor Dad, Robert Kiyosaki gives you the crash-course financial education that you should have learned in school. If you want to accrue wealth, this self-help book is filled with solid advice and success principles for creating a better financial life.

Best Self-Help Books for Creativity

37. The War Of Art By Steven Pressfield

“The counterfeit innovator is wildly self-confident. The real one is scared to death.”

Rating: 10/10

Why it’s Great: If you write or create, read this book. Pressfield names the killer of creative dreams: Resistance. He describes the many forms it takes and outlines a plan to overcome it. If you have creative dreams, Pressfield will prepare and inspire you for the war ahead.

38. The Creative Act by Rick Rubin

“Creativity is not a rare ability. It is not difficult to access. Creativity is a fundamental aspect of being human. It’s our birthright. And it’s for all of us.”

Rating: 9/10

Why it’s Great: Legendary music producer Rick Rubin’s The Creative Act: A Way of Being is a mind-bending series of meditations on what it means to be an artist and creator. Through 78 philosophical musings, Rubin shares the wisdom that we are all artists, offers helpful mental frames for creating and moving through roadblocks, and helps you develop an understanding of what it means to operate as an artist in the world.

39. The Art Of Possibility by Rosamund And Benjamin Zander

“Gracing yourself with responsibility for everything that happens in your life leaves your spirit whole, and leaves you free to choose again.”

Rating: 8/10

Why it’s Great: In this engaging read, a music conductor and an experienced psychotherapist introduce 12 unique personal development practices that will reshape how you see the world and accelerate your personal and professional growth.

40. The Artist’s Way by Julia Cameron

“No matter what your age or your life path, whether making art is your career or your hobby or your dream, it is not too late or too egotistical or too selfish or too silly to work on your creativity.”

Rating: 9/10

Why it’s Great: This timeless, 12-week course is sure to fill your spirit and help you be more creative. Cameron offers heartfelt advice for all creatives and a medley of helpful practices like morning pages and artist dates that will make you a happier, better creative.

How to Get More From Self-Help Books

- To get more out of every self-help and personal growth book you read, check out How to Read a Nonfiction Book. This article will help you get the most out of the time you spend reading, starting with the topic of choosing the right books.

- If you read with a Kindle (highly recommend), check out Readwise, a tool that allows you to access and learn from all of the highlights and notes you make while you read.

- If you struggle to read, try listening to audiobooks with Amazon Audible.

- Finally, I send out a weekly Sunday newsletter, Life Reimagined, with helpful ideas and quotes from good books. If you want to receive small nuggets of wisdom and recommendations for future reading every week, you can sign up below.